How do lenders determine how much to lend

Get quotes from different mortgage lenders. Your lender will also likely do a hard credit check and may require additional documents based on your individual situation such as pay stubs tax returns or bank statements.

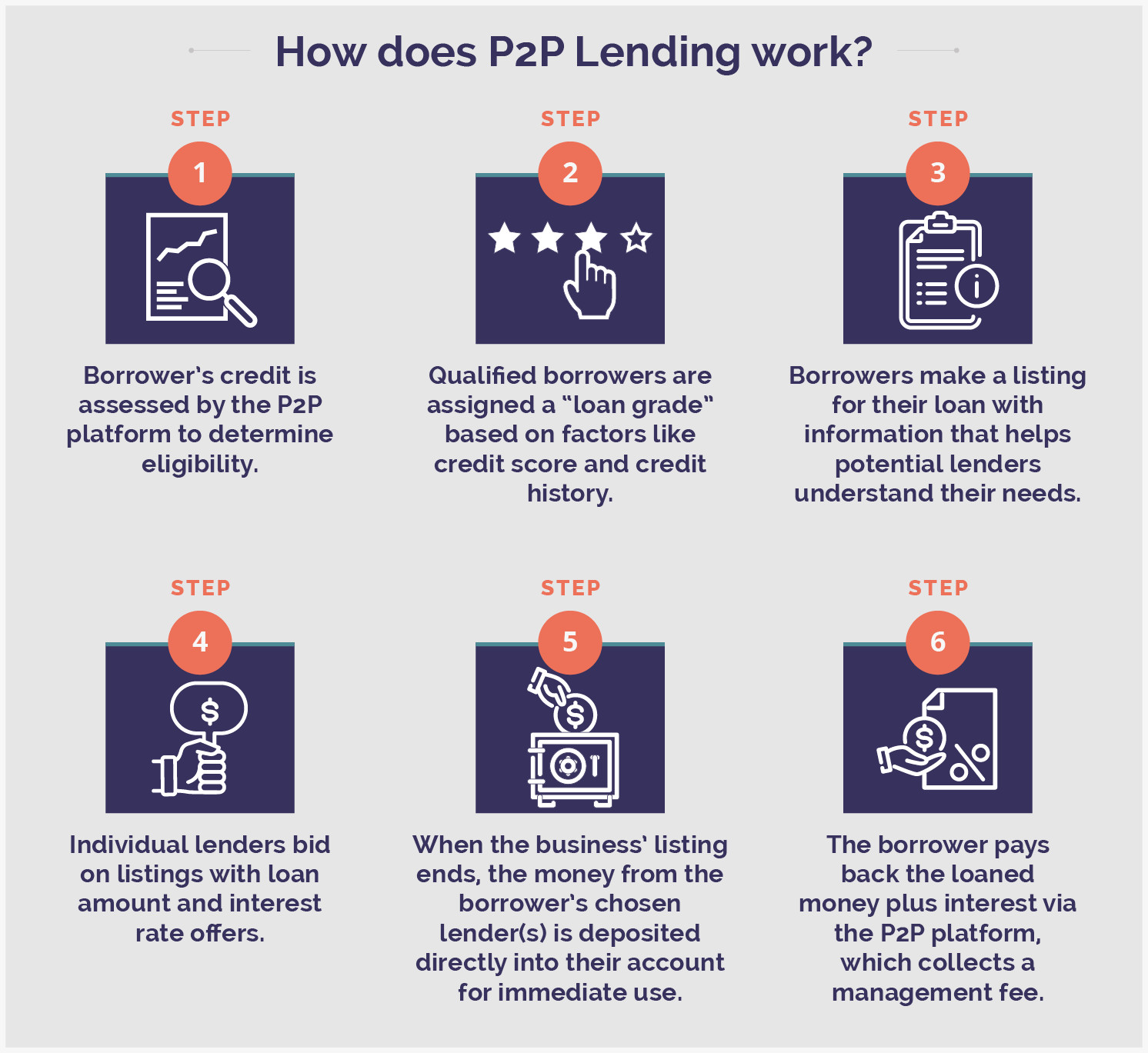

Peer To Peer Lending An Alternative Source Of Finance Peer To Peer Lending Money Management Advice Economics Lessons

The sources of that information include public records such as court judgments CCJs and electoral register information and financial information from lenders utilities suppliers and telecoms businesses.

. Sometimes lenders determine that an in-person appraisal is not needed. These cookies do not collect information that identifies a visitor. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral.

Fund Ourselves now offers IF ISA investment accounts for lenders. Rates start as low as 5 for qualified borrowers. Just as you want to get the best deal on the house you buy you also want to get the best deal on your home loan.

Earn up to 15 pa. Lenders and other organisations carry out searches against that information with one or more credit reference agencies. Lend is the fast hassle-free way to get the best small business loans with the lowest interest rates.

This looks at how much you make in proportion to how much the mortgage will cost you each month including extras like private mortgage insurance homeowners insurance and property taxes. And twenty years ago in a. It has been discussed quite a bit in the past few decades.

And Canada to determine each households risk for conventional loans. You can also transfer your previous years ISAs to Fund Ourselves. Heres how lenders calculate how much to lend you.

For example Berger 2003 discussed the productivity and consumer welfare implications of information technology for banking. Say buyers purchased a home last year but need to sell it today. Review your credit history to see what lenders will see when you ask for a loan.

The higher your score the more credit worthy you are. As long as youre a registered Binance user you can lend your tokens to. Tax-free interest on your short-term peer-to-peer investment.

You can view your credit for freeyou get one free report per year from all three major credit reporting agencies. The same can be said for refinancing a home. However there are banks and online lenders that move much more quickly.

All the points are added together to give a score. When it comes to calculating affordability your income debts and down payment are primary factors. Before you apply determine the following.

A mortgage loan is a very common type of loan used by many individuals to purchase residential or commercial property. Factors that impact affordability. Pre-qualify for your personal loan today.

Because it is so leniently. Lenders may be able to help you determine whether a no tax return mortgage is right for you. The 2836 Rule is a commonly accepted guideline used in the US.

The information these. Lenders might waive a new in-person appraisal because the homes market value was calculated so recently. Well when youre making a big financial decision like applying for a loan its important to review all your options and do thorough research into the lenders you may be applying with.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Functionality cookies - these cookies allow the website to remember choices you make and provide more personal features. USDA Farm Bill A collective effort by all USDA agencies to explain the farm bill provisions and how they affect you.

With Lend for Alls installment loans you can receive as much as 10000 in your bank account in no time all without a credit check. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full. When it comes to how much lenders are willing to let you borrow it generally comes down to two things.

Third with installment loans you can borrow more moneyIn many cases the limit for a payday loan is something like 1500. Your debt and your income according to Nadia Evangelou a senior. Creditors set a threshold level for credit scoring.

Lenders measure each of the five Cs of credit differentlysome qualitative vs. The front-end ratio is also called the housing-expense ratio. This might happen when a home was recently appraised.

It states that a household should spend no more than 28 of its gross monthly income on the front-end debt and no more than 36 of its gross monthly income on the back-end debt. While your personal savings goals or spending habits can impact your. For example Wells Fargo may approve some applicants in as little time as a few minutes while online lender LendingClub reported that in 2018 a majority of LendingClub customers received funds within four days.

Few lenders will let you borrow against the full amount of your home equity. If your score is below the threshold they may decide not to lend to you or to charge you more if they do agree to lend. Introduction Fintech is the topic du jour even though the interplay between information technology and financial services is not a new topic.

Compare apply online for up to 10 business loans including Unsecured Business Loans and get the finance your business needs to grow. Under normal economic circumstances you might be able to borrow between 80 and 90 of your available equity. Different lenders use different systems for working out your score.

Quantitative for exampleas they do not always lend themselves easily to a numerical calculation. Lenders use your debt-to-income DTI ratio to calculate the maximum monthly payment you can afford. Typically lenders cap the mortgage at 28 percent of your monthly income.

If theres not much in there it will generally be harder to get a loan because lenders cant assess your risk as a borrower. If your taxable income is significantly lower than your gross annual income a bank statement mortgage. For example a functional cookie can be used to remember the volume level you prefer to use when watching videos on our websites.

Guaranteed LendersPartners RD and FSA electronic services for loan status and default status reporting. Multi-Family Housing Partners Provide your project budget and tenant residency status information online. Compare personal loans from online lenders like SoFi Marcus and LendingClub.

Its the worlds leading crypto platform and it supports the lending of several cryptos including BUSD and USDT. Start investing now from 1000 and up to your 20000 annual tax-free ISA allowance. Experian TransUnion and Equifax.

Binance is another solid option for crypto lenders. Direct lenders online may also be able to provide you with better customer support as you can generally get help straight from the lenders website.

Need A Personal Loan Here S How To Find Loans And Apply

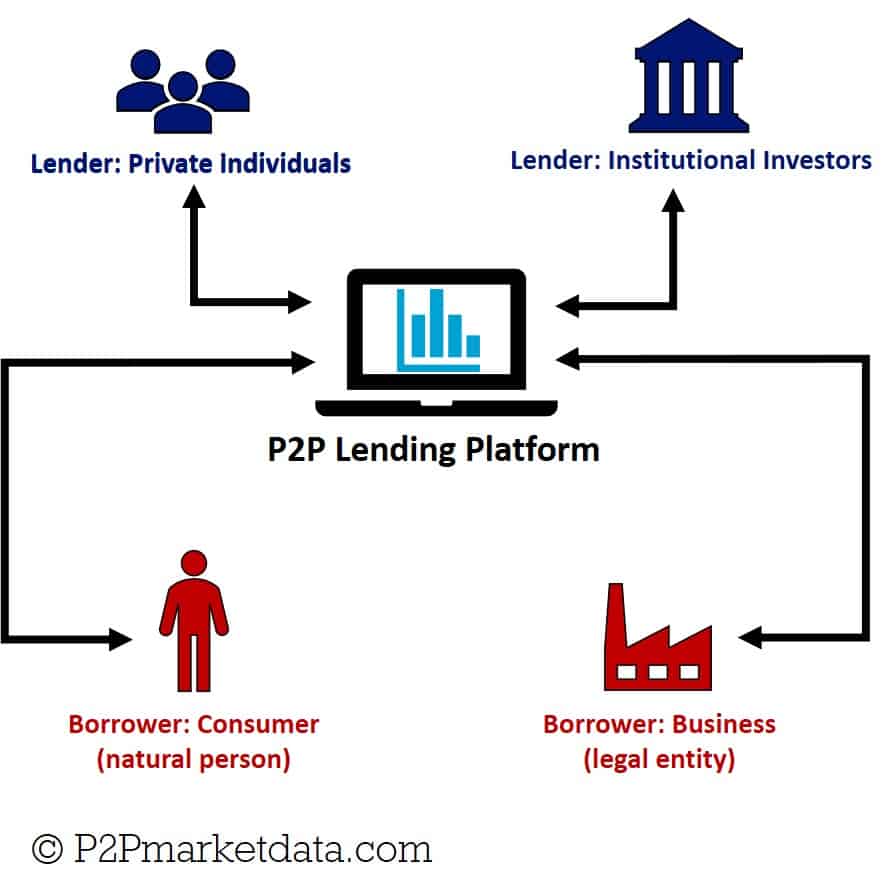

Top Options For Peer To Peer Business Lending Lantern By Sofi

What Is Securities Lending

What Is Peer To Peer Lending How Does It Work Rbi S Latest Guidelines On P2p Lending Platforms Peer To Peer Lending Peer P2p Lending

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

:strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

What Does Heloc Mean In Real Estate A Home Equity Line Of Credit Or Heloc Is A Lo Real Estate Marketing Quotes Real Estate Agent Marketing Real Estate Terms

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

Loan Officer Vs Mortgage Broker What S The Difference

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Family Loan Agreements Lending Money To Family Friends

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

What Is Balance Sheet Lending And How Is It Different To P2p Lending

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Loan Originator Mortgage Approval

How Much House Can I Afford Buying First Home Mortgage Marketing Home Buying Process

Peer To Peer Lending Bonanza Targeted By Mortgage Bank Loandepot Mortgage Banking Peer To Peer Lending Peer

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

A Close Examination Of The Risks And Rewards Of Securities Lending Morningstar